By leveraging the tax-free shop and enjoy shopping in Japan to smart!

By leveraging the tax-free shop and enjoy shopping in Japan to smart!

In October 2014 the “Consumption Tax Exemption Program” was revised in Japan. Due to this all all consumable products including foods, beverages, cosmetics, cigarettes, and pharmaceuticals have become eligible for tax-free procedure.

Contents:

- Mark of the tax-free shop

- Tax-free shop search site & Guidebook Download

- Point of tax-free system

- Exempt products

- Method 1:Purchase it with an amount of money without a consumption tax

- Method 2:Purchase it with the amount of money including the consumption tax and refund a consumption tax at an exemption from taxation counter.

- Attention

1:Mark of the tax-free shop

←The following mark is displayed in a tax-free shop.

(It may not be this mark depending on a duty-free shop.)

2:Tax-free shop search site & Guidebook Download

3:Point of tax-free system

- When you do the shopping in the tax-free shop, You can purchase all products with an amount of money exempted from 8% of consumption taxes.

- The person who can do shopping tax-free is only foreign tourists with less than six months in stay of Japan.

- When you purchase it tax-free, the presentation of the passport is necessary by all means.

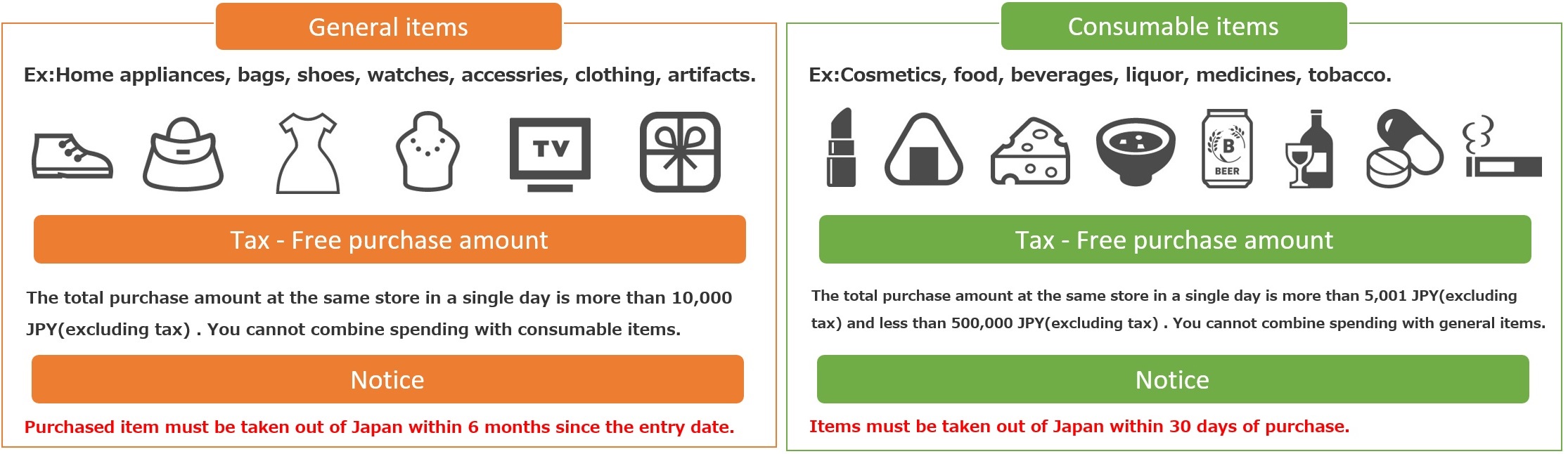

4:Exempt products

5:Method 1:Purchase it with an amount of money without a consumption tax

Tax-free methods may be different by a store to purchase. In that case, please take “procedure method 2” into account.

■Step1: Confirm whether a shop is a duty-free shop.→Duty-free shop Search

■Step2: Choose the product which you want to purchase and you take a product and pay a rate to the payment (exemption from taxation) counter. Rate of this case is the exemptions from taxation(without 8% of consumption taxes).

■Step3: Show a passport and sign a shown buyer written oath from a shop.

■Step4: Stick a purchase record vote on a passport.

■Step5: At the time of return home, you show a tax-free article and a passport (purchase record vote) at the customs of the airport.The purchase record vote is collected here.

6:Method 2:Purchase it with the amount of money including the consumption tax and refund a consumption tax at an exemption from taxation counter.

■Step1: Confirm whether a shop is a duty-free shop.→Duty-free shop Search

■Step2: You pay the product which you want to purchase and I take a product and pay a rate to the counter. Rate of this case is include 8% of consumption taxes.

■Step3: Go to the exemption from taxation counter to receive the refund of the consumption tax. The places of the exemption from taxation counter are different by a shop. Please confirm it to a salesclerk.

■Step4: Show necessary documents at an exemption from taxation counter.[Credit card(when use credit card) ,passport,receipt,product] and sign a buyer written oath and have you stick a purchase record vote on a passport.

■Step5: 8% of consumption taxes that you paid are refunded. (A fee is deducted depending on a shop, and none of 8% may come back.)

■Step6: At the time of return home, you show a tax-free article and a passport (purchase record vote) at the customs of the airport.The purchase record vote is collected here.

7:Attention

・When there are expendable supplies, it is wrapped so that it is not used in Japan. Please never open out until you leave Japan. May be taxed at the time of the departure if you open out.

・You can perform the exemption from taxation procedure only on the day when you purchased it.

・You can perform the exemption from taxation procedure only in the shop which purchased the product. The product which you purchased in a different shop cannot do an exemption from taxation procedure.

・When you purchase it for the purpose of a purpose and sale to use for business, the exemption from taxation procedure is not possible.

How did you like it?

Have a nice trip! XD

<Let’s search the sightseeing information of Kansai in Japan on ‘Japan’s Travel Manual‘!!>

<This site introduces the easiest way to get Japanese (Kansai) sightseeing spots to you.>